What is the new quota system for the self-employed and how will it affect you?

Royal Decree-Law 13/2022, passed on 27 July, established a new contribution system for workers included in the Special Scheme for Self-Employed Workers based on the following for workers included in the Special Regime for Self-Employed Workers based on the net income net income obtained annually from the economic, business or professional activity, as opposed to the system previously the system stablished until now in which, with some limitations, the contribution base was chosen independently of income. Contribution base was chosen irrespective of income. The change will take effect from 2023. A

Below are the most relevant changes.

How the new contribution system for the self-employed works in Spain

We summarise how the new contribution system for the self-employed works:

1.Before the beginning of the year, the self-employed worker must choose the monthly contribution base that corresponds to his forecast of the monthly average of his annual net income within the general table of bases (1) that will be established by the Budget Law each year.

2. During the year, if your monthly income estimate changes, you can request as many base changes as you need. This request can be made up to 6 times a year and will be effective in the immediately following two-month period.

3. In any case, the bases chosen will be provisional until they are regularised.

4. The worker registered as self-employed will be obliged to file an income tax return.

5. The regularisation of the contribution, for the purpose of determining the contribution bases and the final monthly contributions for the corresponding year, will be made on the basis of the annual income once obtained and communicated by the Tax Administration from the following year onwards. The final contribution bases shall be made up of:

a). Professionals: Income from all economic, business or professional activities carried out by the self-employed person in each financial year, either individually or as a partner or member of any type of entity in accordance with the provisions of the rules of of Personal Income Tax.

b). Company employees: Full income derived from the participation in the equity of those entities in which they hold, on the date of accrual of corporation tax, a shareholding equal to or greater than 33% of the share capital or having the status of director, a shareholding equal to or greater than 5%, as well as the total earned income derived from their activity in these entities.

c). Amount of Social Security Contributions.

d). Deduction for generic expenses of 7% for professionals and 3% for company employees

6. Once the amount of income has been determined, it is distributed proportionally over the period to be adjusted (2) and the final bases are determined.

a). If the average income is within the bracket corresponding to the provisional base, no adjustment is made and the provisional base becomes definitive.

b). If the average income is in a higher bracket than the provisional base, the minimum base of the bracket corresponding to the income will be applied as a minimum and the Social Security will issue a supplementary settlement for the differences without surcharge.

c). If the average income is in a lower bracket than the provisional base, the maximum base of the bracket corresponding to the income will be applied and the Social Security will automatically refund the differences before 30 April of the financial year following that in which the definitive bases were determined.

(1) Self-employed persons who are not included in this Regime due to their status as family members of a self-employed person or as administrator or working partner may also opt for the reduced table of bases if they foresee that their average monthly income will not exceed the SMI.

(2) The monthly contribution base applied in the months in which benefits are received for temporary disability, risk during pregnancy, risk during breastfeeding, birth and care of a minor and co-responsible care of the infant, as well as for cessation of activity or for the sustainability of the activity, in those cases in which they must remain registered as Self-Employed, will become definitive and, consequently, will not be subject to regularization.

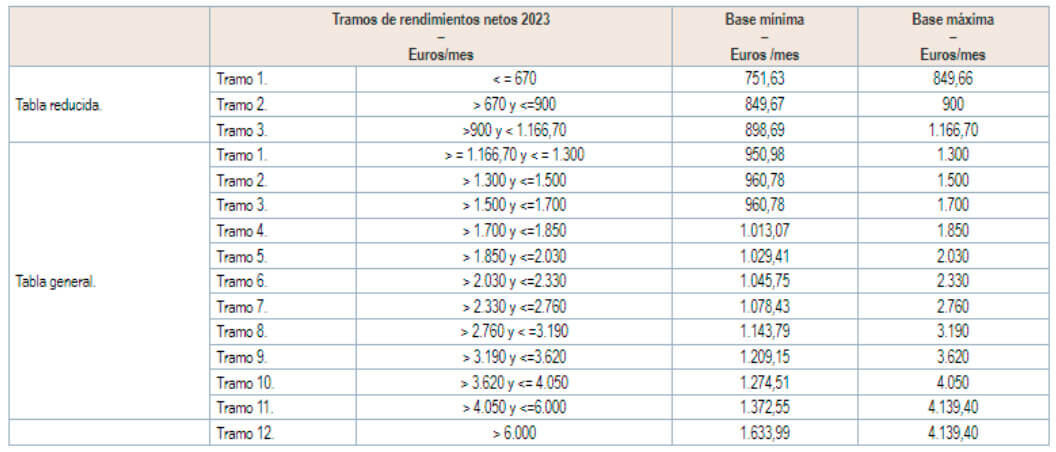

Performance and basis table for 2023

For example:

1.Juan requests a provisional monthly contribution base of €1,050 (within bracket 5). The monthly contribution will be: €1,050.00 x 30.60% = €321.30.

2. Once your personal income tax return has been filed, the net income is €40,000. A discount of 7% (€2,800) is applied to this income and the self-employed contributions are added (€321.30 x 12 = €3,855.60). The result is € 41,055.60. This result is averaged over 12 months as there has been no month without regularisation (illness, child care, etc.): 41,055.60 €/12 = 3,421.30 €.

3. The average yield of €3,421.30 is in bracket 9, so, in Juan’s case, the minimum base of that bracket, €1,209.15, will be applied as definitive for 2023 and the Social Security will issue a supplementary settlement for the difference in contributions between the provisional and definitive bases.

Quota subsidies

Self-employed workers who are initially registered or who have not been registered in the two immediately preceding years (three years if bonuses have been applied previously) will be subject to the following quotas:

For the first 12 months a fee of €80.

During the following 12 months, a contribution of €80, provided that, during the calendar year(s) covered by this second period, they have not obtained net income exceeding the minimum wage (SMI).

Transitional period

Self-employed persons will continue to pay contributions during 2023 at the base that would correspond to them in January, in accordance with the base they already have in 2022, until they exercise their option for a new base according to their income.

The flat rate and other benefits that apply to current self-employed contributions will continue to be applied under the same terms until the maximum periods established for their application are exhausted.

Self-employed persons who, on 31/12/2022, were paying contributions on a higher contribution base than that which would correspond to them on the basis of their income, may maintain that contribution base, or a lower one, even if their income determines the application of a lower contribution base than either of them.

This is important to bear in mind if you need to maintain a higher contribution base than the one that will correspond to your income, as once the new system is implemented you will not be able to “choose” your final contribution base.

Are you self-employed in Spain? How do the new 2023 self-employed quotas affect you? Do you need help?